Future Retirement Planning Secure Your Future

Unlock the Secret to a Secure Future! Expert Tips for Future Retirement Planning. Don't Miss Out! Prepare for Success Now.

Securing Your Future The Importance of Retirement Planning and Saving

Retirement planning and saving for the future are crucial components of a secure and comfortable financial life. In today's world, where personal finance has become increasingly complex, understanding the benefits of these practices is essential for individuals of all ages and income levels. Whether you're just starting your financial journey or looking to fine-tune your existing plan, this article will delve into the advantages of?future retirement planning?and saving for the future while integrating keywords like "personal finance tips," "best investment strategies," "how to save money," "credit score improvement tips," "top stocks to buy," "financial planning for beginners," and "money management tips for beginners."

Personal Finance Tips Building Wealth Over Time

One of the most valuable?personal finance tips?is to start retirement planning early. By doing so, you allow time and compound interest to work in your favor. Compound interest is a powerful financial concept where your earnings generate more earnings. This means that even small contributions made in your early years can grow significantly over time.

Best Investment Strategies: Diversification and Risk Management

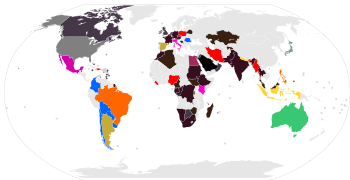

Effective retirement planning involves selecting the?best investment strategies?that align with your financial goals. Diversification is a key strategy here. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk. This reduces the impact of market volatility and improves the chances of steady long-term growth.

How to Save Money: Budgeting and Expense Tracking

To have the funds necessary for retirement planning, you need to know?how to save money. Establishing a budget is a fundamental step in this process. It allows you to track your income and expenses, identify areas where you can cut back, and allocate more funds toward savings and investments.

Credit Score Improvement Tips: Lowering Borrowing Costs

Maintaining a good credit score is essential when considering retirement planning. A higher credit score can lead to lower interest rates on loans and credit cards, which can free up more money for saving and investing. Paying bills on time, reducing credit card balances, and avoiding excessive debt are some?credit score improvement tips?to follow.

Top Stocks to Buy: Consider Your Risk Tolerance

While investing in stocks can be lucrative, it's important to choose wisely. Research the top stocks to buy, but also consider your risk tolerance. Riskier stocks may offer higher returns, but they come with greater volatility. Retirement planning should prioritize a balance between growth and stability to ensure your financial security.

Financial Planning for Beginners: Start Small and Learn

Financial planning for beginners can seem overwhelming, but remember that everyone starts somewhere. Begin with small steps, such as creating a basic budget or opening a savings account. As you gain confidence and knowledge, you can gradually expand your financial planning efforts to include retirement saving and investing.

Money Management Tips for Beginners: Automation and Discipline

Money management tips for beginners?often stress the importance of discipline and automation. Setting up automatic transfers to your retirement accounts ensures that you consistently contribute to your savings, even if you tend to forget. Discipline involves sticking to your budget and resisting impulse purchases that can derail your retirement planning efforts.

The Benefits of Retirement Planning and Saving

Now that we've touched on various personal finance tips and strategies, let's delve deeper into the benefits of retirement planning and saving for the future. These benefits extend beyond just financial security; they impact your overall quality of life and peace of mind.

Financial Freedom and Independence

Retirement planning is your roadmap to financial freedom and independence. It allows you to take control of your financial future, reducing the reliance on government or employer-sponsored plans. With sufficient savings, you can retire on your own terms, pursuing hobbies, travel, or other interests without the burden of financial stress.

Reduced Stress and Anxiety

Financial stress can take a toll on your physical and mental well-being. Knowing that you have a well-thought-out retirement plan in place can significantly reduce stress and anxiety. It provides a safety net that allows you to face unexpected financial challenges with confidence.

Maintaining Your Lifestyle

By saving and planning for retirement, you can maintain your desired lifestyle in your golden years. This means having the financial means to cover daily expenses, healthcare costs, and the occasional splurge without sacrificing your standard of living.

Legacy Planning

Retirement planning isn't just about your own financial well-being; it also allows you to plan your legacy. You can allocate funds for your loved ones or charitable causes that are important to you. Effective retirement planning ensures that your wealth is distributed according to your wishes.

Tax Benefits

Many retirement savings vehicles offer tax benefits. Contributions to retirement accounts, such as 401(k)s and IRAs, can often be deducted from your taxable income. Additionally, the earnings on these accounts can grow tax-deferred, meaning you don't pay taxes on them until you withdraw the funds during retirement.

Social Security Supplement

Retirement planning doesn't mean relying solely on personal savings. It complements government programs like Social Security. The more you save, the less dependent you'll be on Social Security benefits, and the more you can use them as a supplement to your retirement income.

Inflation Protection

Over time, the cost of living typically increases due to inflation. Effective retirement planning takes this into account and ensures that your savings and investments keep pace with rising prices. This protects your purchasing power in retirement.

Peace of Mind

One of the most valuable benefits of retirement planning is the peace of mind it provides. Knowing that you have a well-structured plan in place, with a diversified portfolio of investments, allows you to face the future with confidence. It eliminates the uncertainty that often accompanies financial unknowns.

Flexibility and Adaptability

Retirement planning isn't a one-size-fits-all endeavor. It's adaptable to your changing circumstances and goals. Whether you want to retire early, travel the world, or start a second career, effective retirement planning gives you the flexibility to adjust your plans accordingly.

A Comfortable Retirement

Ultimately, retirement planning and saving for the future are about achieving a comfortable retirement. It's about enjoying your later years without worrying about financial constraints. By following personal finance tips, employing the best investment strategies, and consistently saving, you can make this goal a reality.

Retirement planning and saving for the future are indispensable components of sound personal finance. The benefits of these practices extend far beyond financial security, encompassing reduced stress, peace of mind, and the ability to maintain your desired lifestyle. By following personal finance tips, adopting the best investment strategies, learning how to save money, improving your credit score, and making informed choices about stocks and financial planning, you can pave the way for a prosperous and fulfilling retirement. Remember, it's never too early or too late to start planning for your future.

What's Your Reaction?