Best Time to Trade Forex on cTrader: A Guide to Forex Market Hours

Understanding forex market hours is essential for traders using cTrader, as different trading sessions offer varying levels of liquidity, volatility, and trading opportunities. The forex market operates 24 hours a day, divided into major trading sessions, each with unique characteristics. In this guide, we’ll explore the best times to trade forex on cTrader, how different market hours impact trading strategies, and tips for maximizing profitability.

Introduction

Understanding forex market hours is essential for traders using cTrader, as different trading sessions offer varying levels of liquidity, volatility, and trading opportunities. The forex market operates 24 hours a day, divided into major trading sessions, each with unique characteristics. In this guide, we’ll explore the best times to trade forex on cTrader, how different market hours impact trading strategies, and tips for maximizing profitability.

Overview of Forex Market Hours

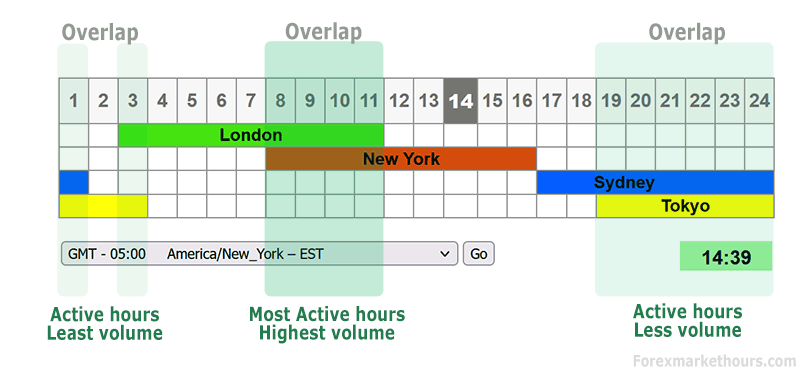

The forex market is divided into four major sessions:

-

Sydney Session: 10 PM – 7 AM GMT

-

Tokyo (Asian) Session: 12 AM – 9 AM GMT

-

London Session: 8 AM – 5 PM GMT

-

New York Session: 1 PM – 10 PM GMT

Each session has different levels of volatility and liquidity, affecting how traders should approach the market on cTrader.

Best Time to Trade Forex on cTrader

1. London and New York Session Overlap (1 PM – 5 PM GMT)

-

Why Trade?

-

Highest liquidity and volatility.

-

Major currency pairs like EUR/USD, GBP/USD, and USD/JPY see strong price movements.

-

Ideal for scalping, day trading, and breakout strategies on cTrader.

-

-

cTrader Features to Use:

-

Depth of Market (DOM) to assess liquidity levels.

-

cTrader Automate for high-frequency trading bots.

-

2. Asian Session (Tokyo) (12 AM – 9 AM GMT)

-

Why Trade?

-

Lower volatility but stable trends.

-

Best for trading JPY pairs like USD/JPY and AUD/JPY.

-

Suitable for range trading strategies.

-

-

cTrader Features to Use:

-

Custom indicators to analyze trend stability.

-

One-click trading for quick execution during slow market conditions.

-

3. London Session (8 AM – 5 PM GMT)

-

Why Trade?

-

One of the most liquid sessions.

-

High volatility in GBP pairs like GBP/USD and EUR/GBP.

-

Good for momentum and breakout trading.

-

-

cTrader Features to Use:

-

Advanced charting tools to identify trends and breakouts.

-

cTrader Copy to follow experienced traders.

-

4. New York Session (1 PM – 10 PM GMT)

-

Why Trade?

-

Strong movements in USD-related pairs.

-

High trading volume, especially during economic news releases.

-

Ideal for trend-following strategies.

-

-

cTrader Features to Use:

-

Automated trading bots to react quickly to news events.

-

Economic calendar integration for tracking major announcements.

-

Worst Times to Trade on cTrader

-

Weekend Trading (Saturday & Sunday): Forex markets are closed, and spreads widen significantly.

-

Low Volatility Periods (Between Sessions): Example: 9 AM – 12 PM GMT, when the Asian session ends but before London gains momentum.

-

Public Holidays: Liquidity drops, causing erratic price movements.

Tips for Optimizing Trading on cTrader Based on Market Hours

-

Use Session-Specific Strategies:

-

Scalping and breakout trading during high volatility periods.

-

Range-bound strategies during the Asian session.

-

-

Monitor Economic Events:

-

Use cTrader’s built-in news feed to track major announcements that impact forex market hours.

-

-

Adjust Trading Volume and Leverage:

-

Lower leverage and volume during low volatility periods to manage risk.

-

-

Utilize cTrader Automate:

-

Set up automated bots to execute trades at optimal times.

-

Conclusion

The best time to trade forex on cTrader depends on your strategy and the level of market activity. The London-New York overlap offers the highest volatility, while the Asian session provides steady trends. By leveraging cTrader’s advanced tools, traders can maximize their profitability based on market hours. Understanding when to trade and using the right platform features will help you gain an edge in the forex market.

What's Your Reaction?